This article is part of the “Business case for Sustainability” series on the Zerwaste blog. In this post, we will try to establish criteria and methods to evaluate the ROI of sustainability.

Welcome to the Business case for Sustainability Series!

For a long time, business leaders had the wrong perception that a company can have profits or sustainability, but not both due to historical low quality, higher prices of products, and low return of socially responsible investments. Fortunately, the trend has now been reversed.

Today, business leaders and investors agree that business success will require a commitment to sustainability.

Operating a greener business has become “the right thing to do” to help protect the environment and address climate change and increase business benefits.

In this article, we will therefore focus on the ROI (Return on Investment) of voluntary environmental and social management and on how to build a business case for sustainability that intends and realizes economic success through (and not just with) an intelligent design of sustainable practices.

In a future article, we will focus on how to integrate the economic and the altruistic impact in your sustainability strategy, but here we will focus on how to assess the benefits and costs of sustainable practices.

But first, let’s start with the definition of “sustainable practices”.

Sustainable Practices are practices that:

- Do not harm people or the planet and at best create value for stakeholders.

- Focus on improving ESG (Environmental, Social, and Governance) performance in the areas in which the company or brand has a material environmental or social impact (such as in their operations, value chain, or customers).

- Contribute to the solution of societal or environmental problems through voluntary or mainly voluntary activity, with intention and not just for legal enforcement, regulations, or support of employee volunteering, for instance.

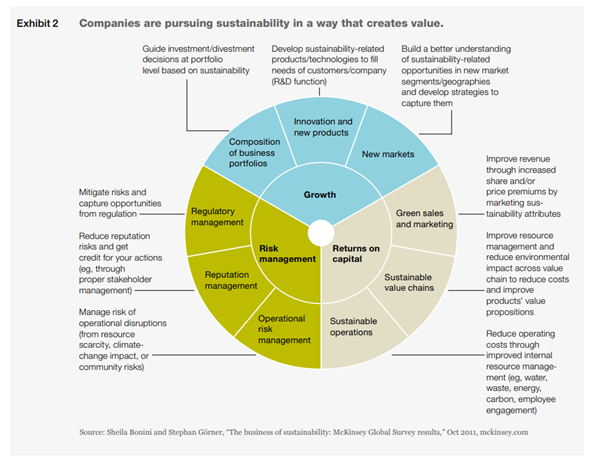

The objective is to reach financial sustainability through those sustainable practices and measure a firm’s financial sustainability in terms of four conditions:

- The firm’s growth.

- The company’s ability to survive.

- An acceptable overall level of earnings risk exposure; and

- An attractive earnings risk profile.

Why Is It Important To Measure the Impact of Your Efforts?

Business leaders are looking for meaningful metrics to make sustainability part of the corporate culture and to prove that investing in sustainability makes sense for the health of the organization.

Measuring the impact, you have is not a choice for organizations anymore as so many stakeholders demand it: customers, employees, investors, governments… Metrics can be used to prioritize concrete actions to respond to these demands.

In a 2017 trends survey by Ethical Corporation, 55% of companies are not measuring the ROI of sustainability initiatives, despite 74% of respondents stating that CEOs appreciate the value of sustainability.

Why should this lack of ROI measurement cause concern?

Investment decisions from most business functions are judged and tracked according to how they add value to the business and if the business value of sustainability is unproven, investments will most likely be the first to go.

Finally, if you can measure it, you can improve your actions, but you also need a clear strategy to calculate carefully how much effort you should exert, where those efforts should be focused, and when you can expect returns on these investments.

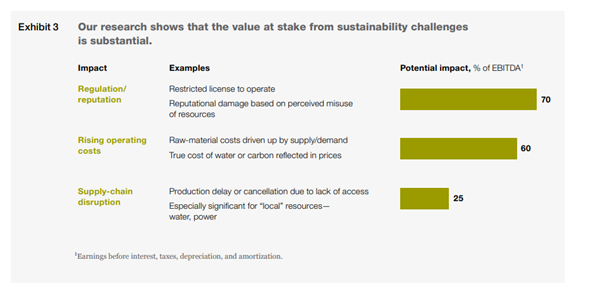

McKinsey reports that the value at stake from sustainability concerns can be as high as 70% of earnings before interest, taxes, depreciation, and amortization.

What Should We Do To Evaluate Returns on These Investments?

Return on investment should be considered as a reason to get started on sustainability. A shift to sustainable business practices, new greening policies, procedures, or activities are also good for business and the bottom line. Those practices can often save money by themselves.

“Some firms invest in sustainability because the business case is so glaringly obvious, they’d be foolish not to.”

— Henderson

Direct cost savings from efficiency improvements are easier to measure as part of basic cost-benefit analysis. Nevertheless, a lot of other elements could contribute to the business case. With the right data and tracking, it is perfectly possible to model out the contribution of sustainability to the overall brand, talent, and reputation value, providing a much truer measure of sustainability ROI.

To analyze (financial) benefits, we have broken them down into three groups:

We will get back to those groups in more detail in the rest of the series.

How Can We Calculate the ROI of Something With Such a Wide and Intangible Scope?

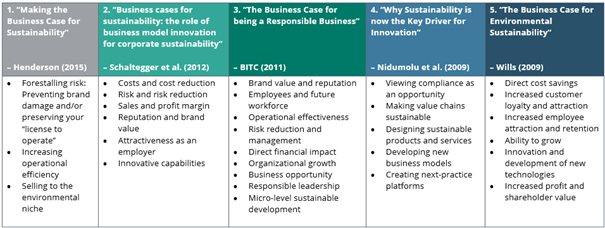

In a recent Harvard Business Review article, it was mentioned that three approaches have been followed to make sustainability profitable in addition to following the basic regulations:

- Start with a more extensive investment to generate long-term (lower) yield.

- Launch quick wins to save money and fund bigger sustainable initiatives.

- Share efforts with your customers and suppliers to create industrial symbiosis and innovative business models.

To be able to calculate the ROI of specific initiatives, it is key to analyze the situation, track the results and the risk coefficient, and calculate the TCO which refers to the lifetime cost of buying, owning, and operating an asset or a project.

Conclusion

Sustainability initiatives are initially about the planet, but they will also lead to positive financial impacts, growth through new markets, increased sales, cost reduction, employee recruitment and satisfaction, reduced risk and reputation issues, operational efficiency, and effectiveness, and greater, sustained and optimized investment leading to meaningful change.

As we will see in future articles, there is no lack of quantitative evidence to show the profitability of sustainability with corporations actively managing and planning for climate change having:

- 18% higher ROI (S&P 500 corporations)

- 20% sales boost, 13% productivity, and 6% share price increase

- 10% increase in customer satisfaction.

In addition, a billion dollars or more in revenue have been generated annually by at least nine companies globally from sustainable products or services.

Unfortunately, there is not a one size fits all way to integrate sustainability depending on how big the company is, how the SDGs have been integrated into the strategy blueprint, and what the trigger for commitment to sustainability is (risk management, growth…). The good news is that no matter where your company stands, there are always quick wins or longer-term projects to better manage natural resources and bring tangible results with a strong Return on Investment.

See you soon for more information on the sustainability business case!

Sources

Making Sustainability Profitable (hbr.org)

Business Cases for Sustainability | SpringerLink

The ROI of Sustainability: How Green Leads to Green | Forrester Europe

Proof That Sustainability Can Be Profitable – Limelights

The Return on Investment (ROI) of Sustainable Business – Green Business Bureau

Profits with Purpose. ashx (mckinsey.com)

Annexes